August 2024 Market Report: Navigating the Shifts in Real Estate

MBS Road Signs: Week of August 2024

The first week of August has delivered critical insights into the economy, the labor market, and the housing sector. The Federal Reserve held rates steady but hinted that a cut may be on the horizon, while signs of labor market weakness emerged, and home prices hit a new high. Here’s a closer look at the headlines that shaped the week:

- Fed Holds Rates Steady, Hints at September Cut

After eleven rate hikes since March 2022, the Federal Reserve chose to maintain the Federal Funds Rate within the 5.25% to 5.5% range. This marks the eighth consecutive meeting where rates were left unchanged. Despite this, cooling consumer inflation and a slowing economy have fueled speculation that a rate cut could be imminent. Fed Chair Jerome Powell stated that while a September cut isn't guaranteed, it’s on the table if the economic data aligns with their expectations.

- Weak July Jobs Report Reflects the True State of the Economy

The July Jobs Report showed a mere 114,000 jobs created, falling short of the 175,000 expected. This weak performance was further compounded by downward revisions for May and June, as well as a rise in the unemployment rate to 4.3%, the highest since October 2021. The number of people employed part-time for economic reasons also increased significantly, indicating underlying weakness in the labor market.

- Private Payrolls Hit Lowest Level Since January

ADP's Employment Report revealed that private sector job creation slowed for the fourth consecutive month, with only 122,000 new jobs added in July. Small businesses, in particular, struggled, shedding 7,000 jobs, while medium and large businesses managed to add 132,000 jobs combined. This slowdown in job growth, coupled with decelerating wage increases, is a key focus for the Fed as they monitor inflationary pressures.

- JOLTS and Jobless Claims Highlight Labor Sector Weakness

The latest Job Openings and Labor Turnover Survey (JOLTS) reported a decline in job openings to 8.184 million in June, down from a peak of 12 million in 2022. The hiring rate also dropped to a decade-low (excluding the COVID period), and unemployment claims reached their highest level this year. These indicators suggest a softening labor market, which could influence the Fed’s upcoming decisions on rate cuts.

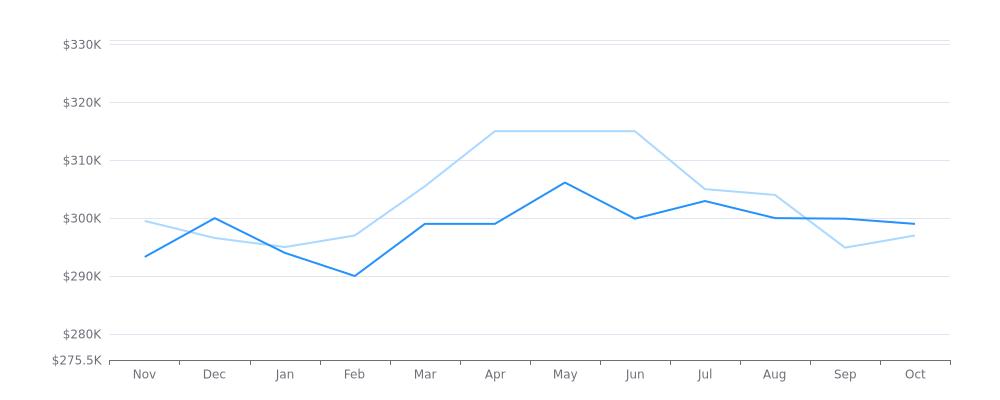

- Home Prices Hit New Record High

The Case-Shiller Home Price Index, a benchmark for home value appreciation, showed a 0.3% increase in home prices from April to May, setting a new all-time high. Year-over-year, home values were up 5.9%. The Federal Housing Finance Agency (FHFA) also reported a 5.7% annual increase in home prices. These figures highlight the resilience of the housing market, reinforcing its position as a strong investment option.

- Pending Home Sales Surge in June

Pending Home Sales rose 4.8% from May to June, significantly outperforming the 1% increase that was anticipated. While sales were still 2.6% lower than a year ago, this marks a recovery from May’s 6.6% year-over-year decline. The increase in housing inventory has eased competition among buyers, creating more favorable conditions for those in the market.

Family Hack of the Week: Celebrate National Peach Month

August is National Peach Month, and what better way to celebrate than with a simple yet delicious Peach Crisp? This recipe is perfect for enjoying the last days of summer.

- Preheat your oven to 350°F.

- Arrange 4 cups of sliced peaches evenly in an 8x8-inch baking dish.

- In a bowl, mix 1/2 cup all-purpose flour, 1/2 cup brown sugar, 1/2 cup cold butter, 1 teaspoon cinnamon, and 1/4 teaspoon salt until crumbly. Fold in 1 cup rolled oats.

- Sprinkle the topping over the peaches and press down lightly.

- Bake for around 30 minutes until crispy and golden brown. Serve warm with vanilla ice cream.

Categories

Recent Posts